Your Business May Qualify for up to $26,000 Per Employee in Payments Waiting For You

Let the experts at Evolved ERC ensure you maximize the credits you deserve from this one-time opportunity. We do nearly all the hard work for you with zero-risk or upfront fees. Plus we’ll help you create even more employee productivity and passion for work using our free & exclusive Evolved Employee Rewards™.

Evolved ERC is a division of Evolved Profits and since 2010, our team has saved businesses like yours over $1 Billion.

What is the Employee Retention Credit (ERC)?

The ERC was a tax credit for businesses authorized by the government for billions in economic stimulus supporting businesses who were negatively affected by COVID-19 and kept employees on payroll.

It was created as part of the CARES Act passed by Congress in March 2020 and has since been amended through the Taxpayer Certainty and Disaster Tax Relief Act of 2020 and again through the American Rescue Plan in 2021. With the passage of the Infrastructure Investment and Jobs Act of 2021 the ERC was effectively ended, although credits can still be claimed.

This new regulation has been changed four times, so it’s no wonder many professionals mistakenly provide inaccurate advice that costs you lost time and significant payment credits you legally deserve. Don’t miss your one chance to receive the payments you deserve.

How much money can I expect to reclaim?

The ERC Refund is up to $7,000 quarterly per employee of the 941 taxes, health benefit costs, COVID related family leave, and COVID vaccination benefits paid by employers from January to September 30, 2021.

You may be eligible to claim a $5,000 credit for 2020 and up to a $21,000 credit for 2021.

Evolved ERC Examples:

Restaurant franchise with 350 Employees received PPP and forgiven – qualified for a recovery of $2,935,000.00

Trade association with 14 employees received PPP and forgiven – qualified for recovery of $418,000.00

Senior Home Care company with 14 employees qualified for a recovery of $44,000.00

Restaurant with 19 employees qualified for a recovery of $59,000.00

Home Care Services Company with 123 employees was told by accountant, bookkeeper and payroll company she did not qualify. Evolved ERC was able to show they were incorrect and now estimated recovery is $1,200,000.00

How can I qualify for the Employee Retention Credit (ERC)?

Your business needs to have been affected in at least one of two ways to qualify:

1. A 20% reduction in gross receipts of a quarter of the same quarter in 2019

– OR –

2. A partial or complete suspension of business due to government mandates during 2020 or 2021. (This may include interrupted operations, supply chain interruptions, inability to access equipment or vendors, cutting hours of operation, etc.)

Even if you or your advisors have previously looked at your situation, some of the qualifications have changed so don’t allow this rightful compensation to go unclaimed by your business.

What if I received a Paycheck Protection Program (PPP) Loan?

If you qualified for a PPP Loan you can still qualify for the ERC tax credit.

Our Evolved Process

1

A complete evaluation to determine your eligibility with detailed analysis.

2

Full guidance on the process, documentation, filing the claim and tracking your tax credit refund.

3

Only after receiving tax credit refund your fee is due. (Remember, we charge zero upfront fees and there is no zero-risk.)

4

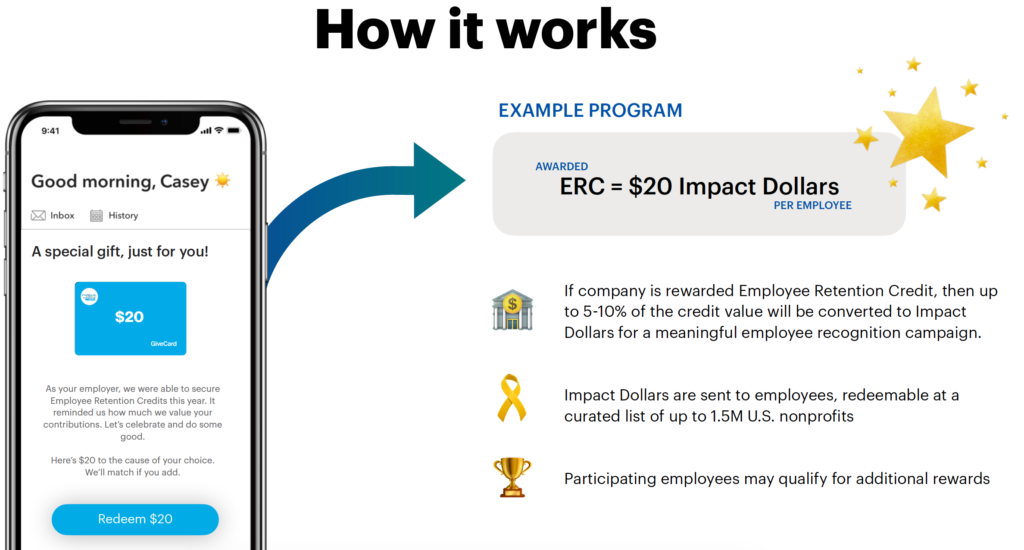

Finally we automatically create the exclusive Evolved Employee Rewards™ program for your team making you look like a hero without any additional cost for you.

We have found most bookkeepers, payroll processors and regular CPAs are not up to the latest qualifications and program changes.

Our Evolved Employee Rewards™ program provides an opportunity for every employee to make a charity donation to a cause they care about which has been shown to improve productivity, engagements and passion at work. (See below for more details)

UNDERSTANDING THE COMPLEX PROGRAM RULES AND BEING AVAILABLE TO ANSWER YOUR QUESTIONS

Factoring the PPP loan into the ERC refund

The differences in the program for 2020 and 2021

The aggregation rules for larger multi-state employers

The effects of State specific Executive Orders

Employee classifications: Full Time, Part Time, Union, tipped employees and how they affect refund amounts

FAQs – ERC Frequently Asked Questions

Are 2020 and 2021 both covered under the ERC?

The ERC tax credit began in March 2020 and continues through September 2021.

If we received a PPP Loan can we still receive ERC credits?

If you received a PPP Loan you qualify for Employee Retention Credit (ERC) tax credits.

If my business had less than a 20% or 50% decline in gross receipts do we qualify?

Your business needs to have been affected in at least one of two ways to qualify:

• A partial or complete suspension of business due to government mandates during 2020 or 2021

• A 20% or 50% reduction in gross receipts of a quarter of the same quarter in from 2019 or 2020

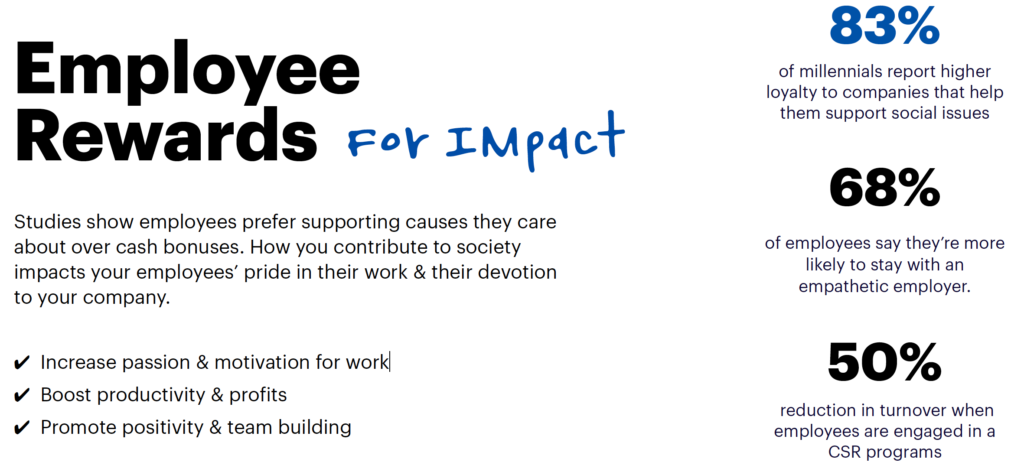

Evolved Employee Rewards™

We want to thank you for supporting your employees during this critical period with the exclusive Evolved Employee Rewards™ program.

By taking 5% of our fees we make you look like a hero without any additional cost to you. (Of course, you are welcome to match this amount but never required.)

These Evolved Employee Reward giving cards are pre-funded so each employee can support any of 1.5M+ charities they personally care about.